A hydroponic grow system is a method of growing plants without soil, using nutrient-rich solutions and a variety of techniques to provide the plants with the necessary nutrients and support. This can include systems like deep water culture, where plants are grown in a nutrient-rich solution, or ebb and flow systems, where a nutrient solution is periodically flooded over the roots of the plants. Hydroponic systems can be used to grow a wide variety of plants, including vegetables, fruits, and herbs, and can be used in both indoor and outdoor settings. They can be beneficial for growing plants in areas with limited space or poor soil quality, and can also help to conserve water and reduce the use of pesticides.

Revolutionary Hydroponic Grow System for Faster, More Efficient Plant Growth

Are you looking for a more efficient and effective way to grow your plants? Look no further than our hydroponic grow systems! We are thrilled to introduce our new line of hydroponic grow systems, designed to help you achieve faster, more efficient, and more productive plant growth. We understand that starting a new gardening venture can be overwhelming, which is why we're here to make the process as easy and stress-free as possible.

Hydroponic systems allow plants to grow in a controlled environment using nutrient-rich water instead of soil. With faster growth rates, better control over growing conditions, and reduced risk of pests and diseases, hydroponic systems are a great choice for anyone looking to take their gardening to the next level.

The Main Idea Behind Hydroponic Grow Systems

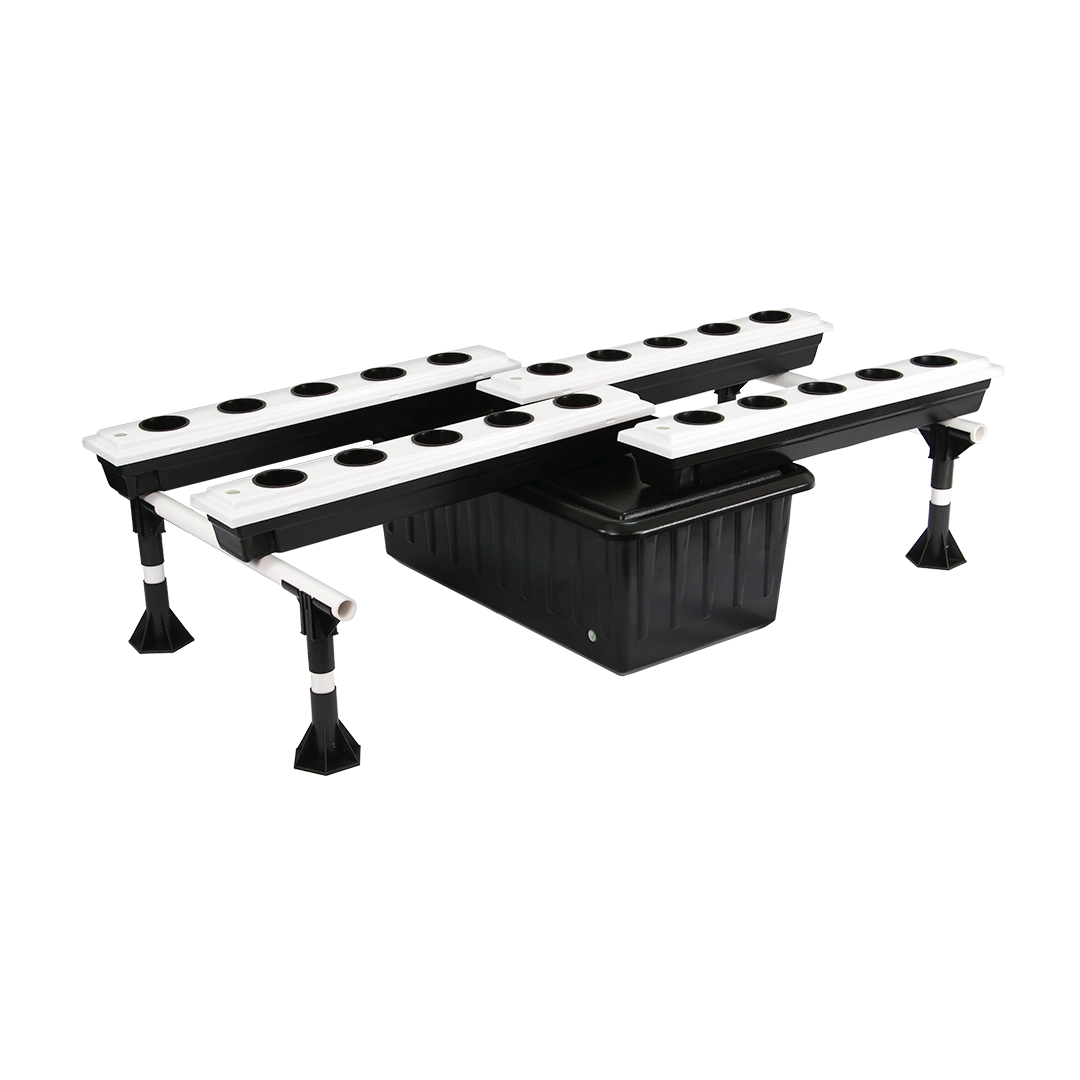

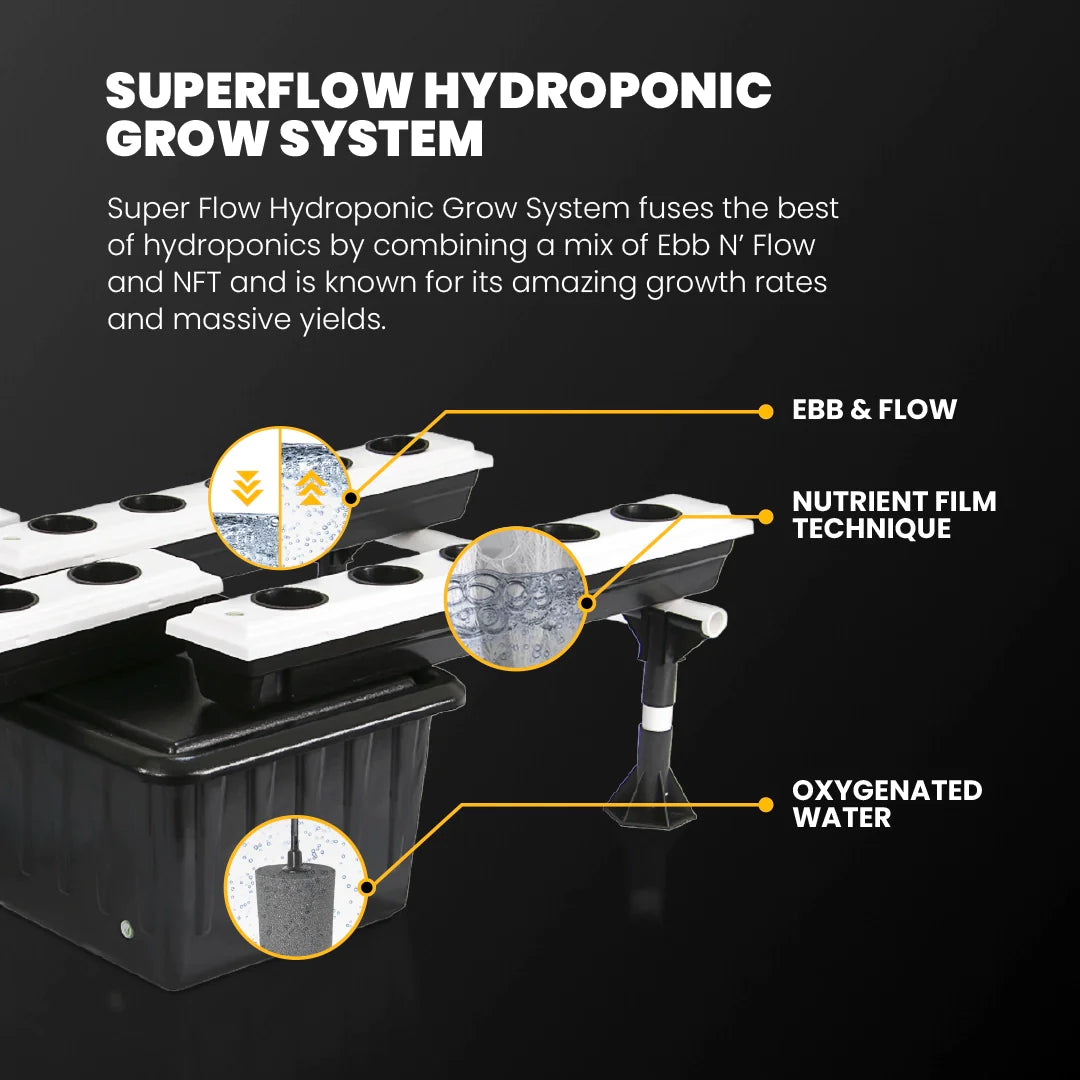

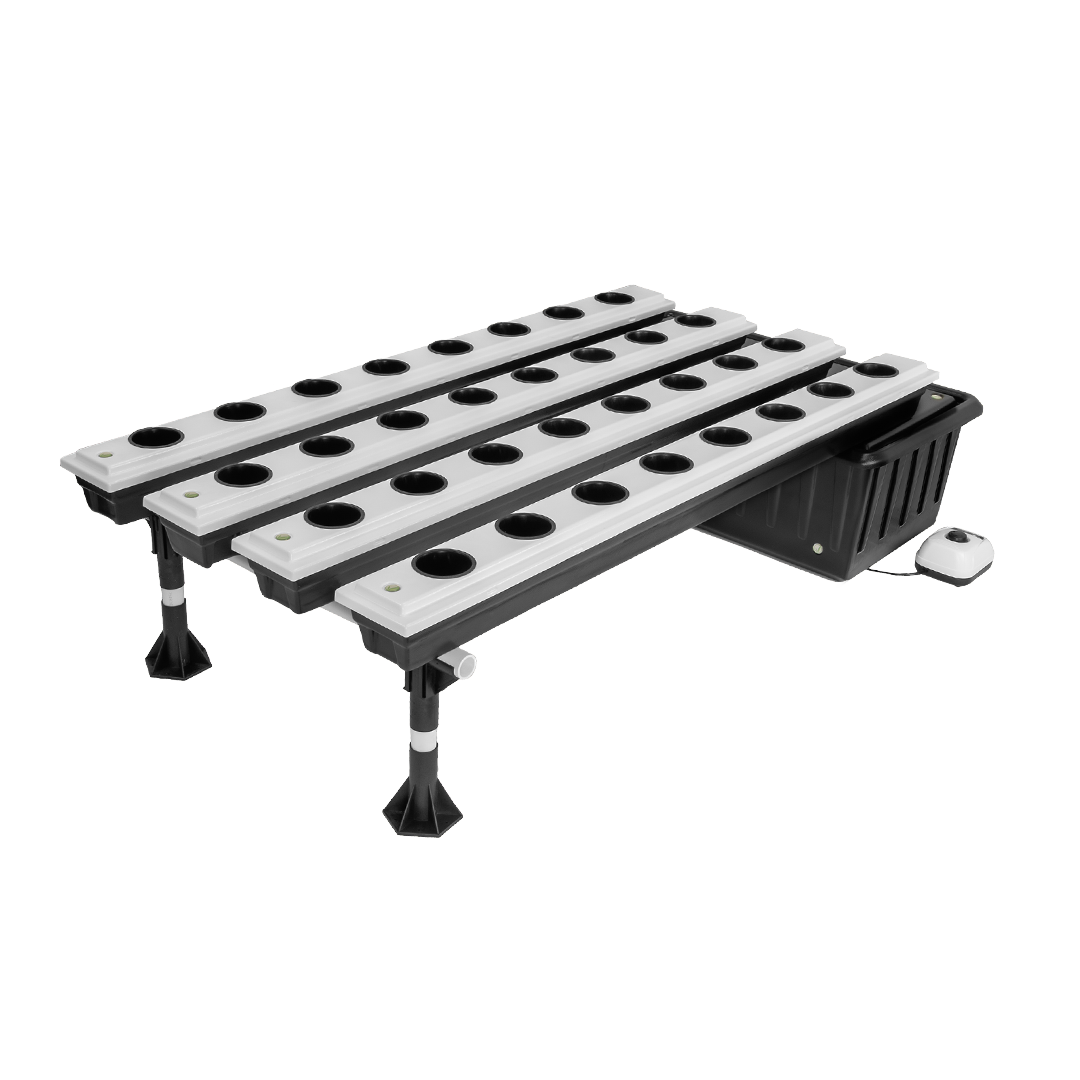

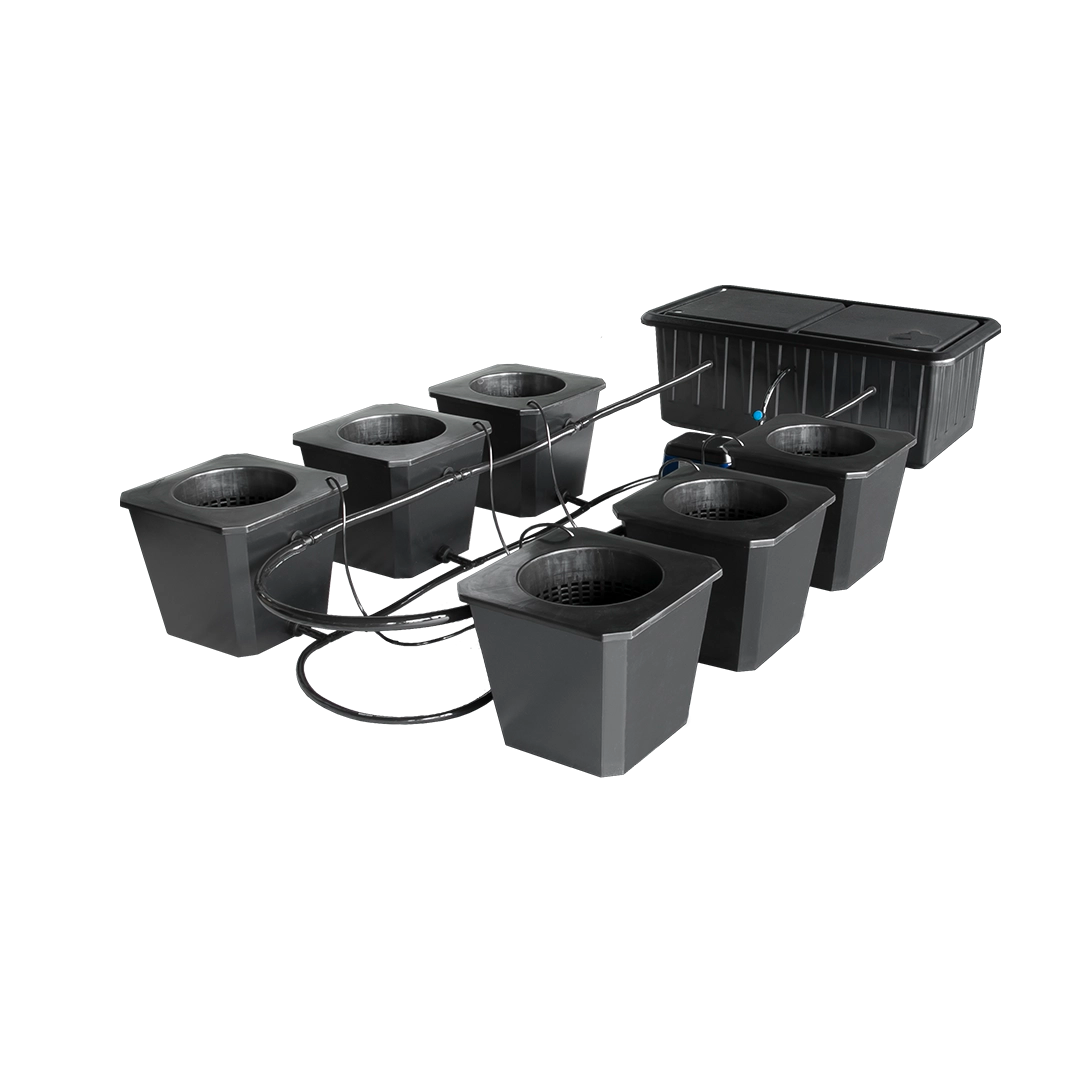

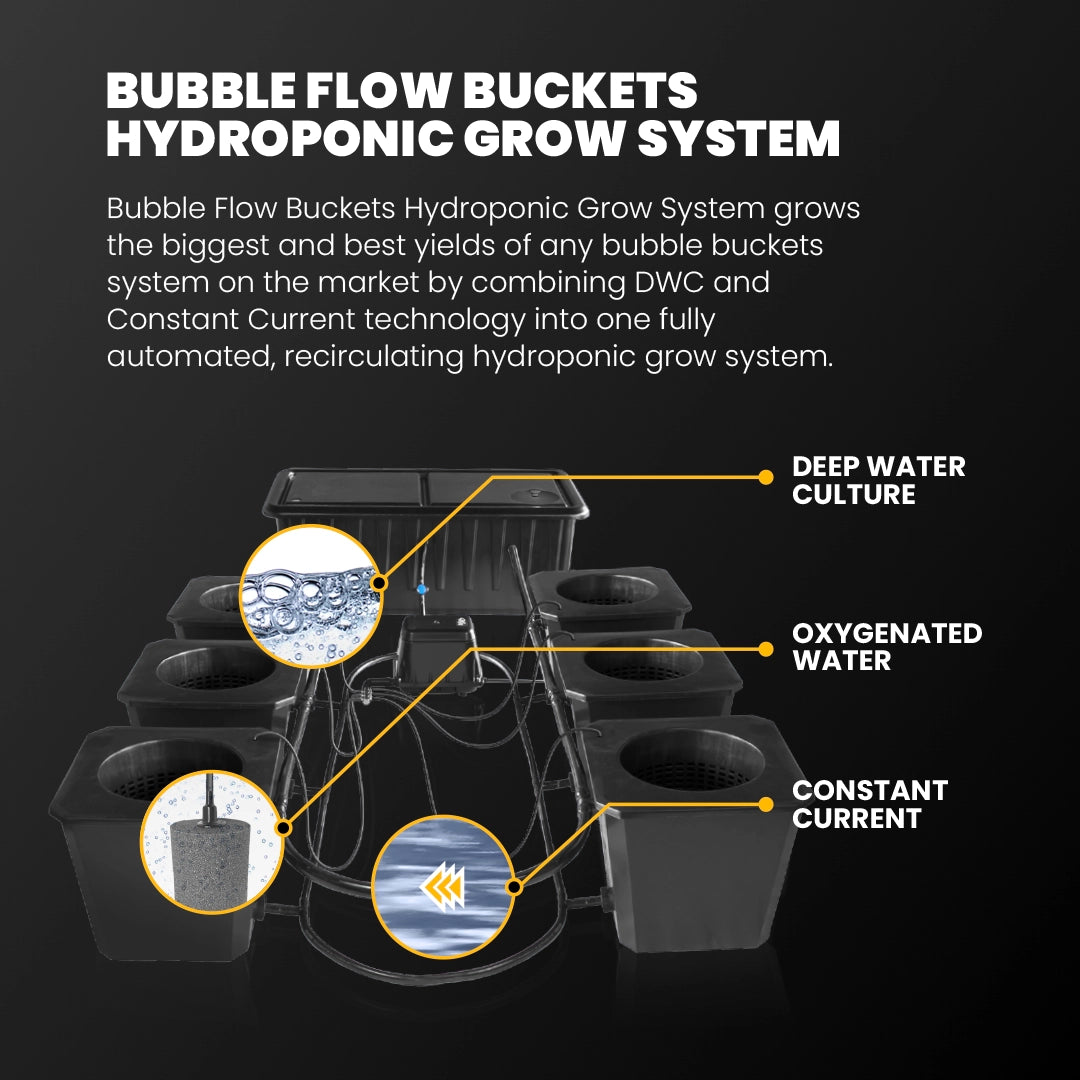

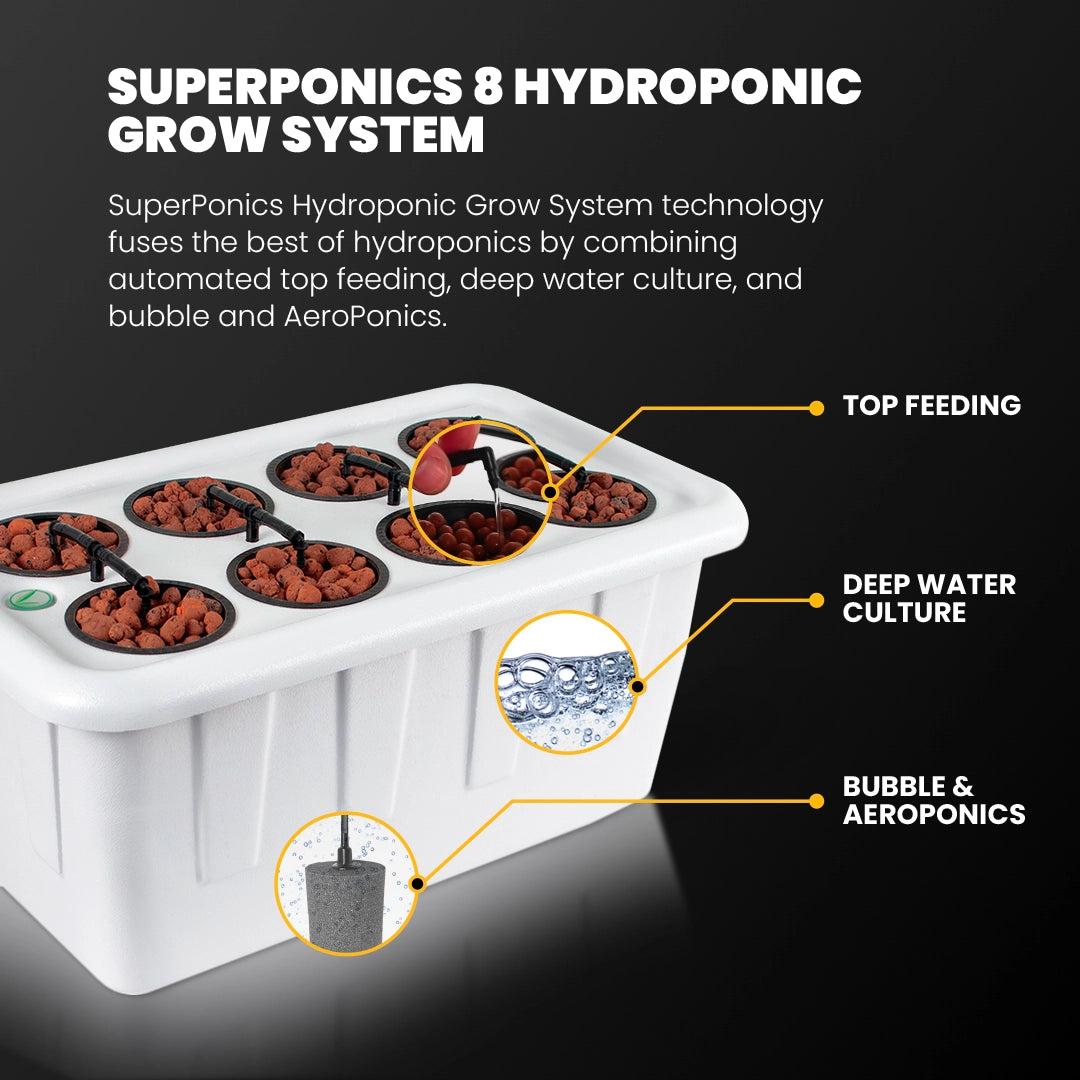

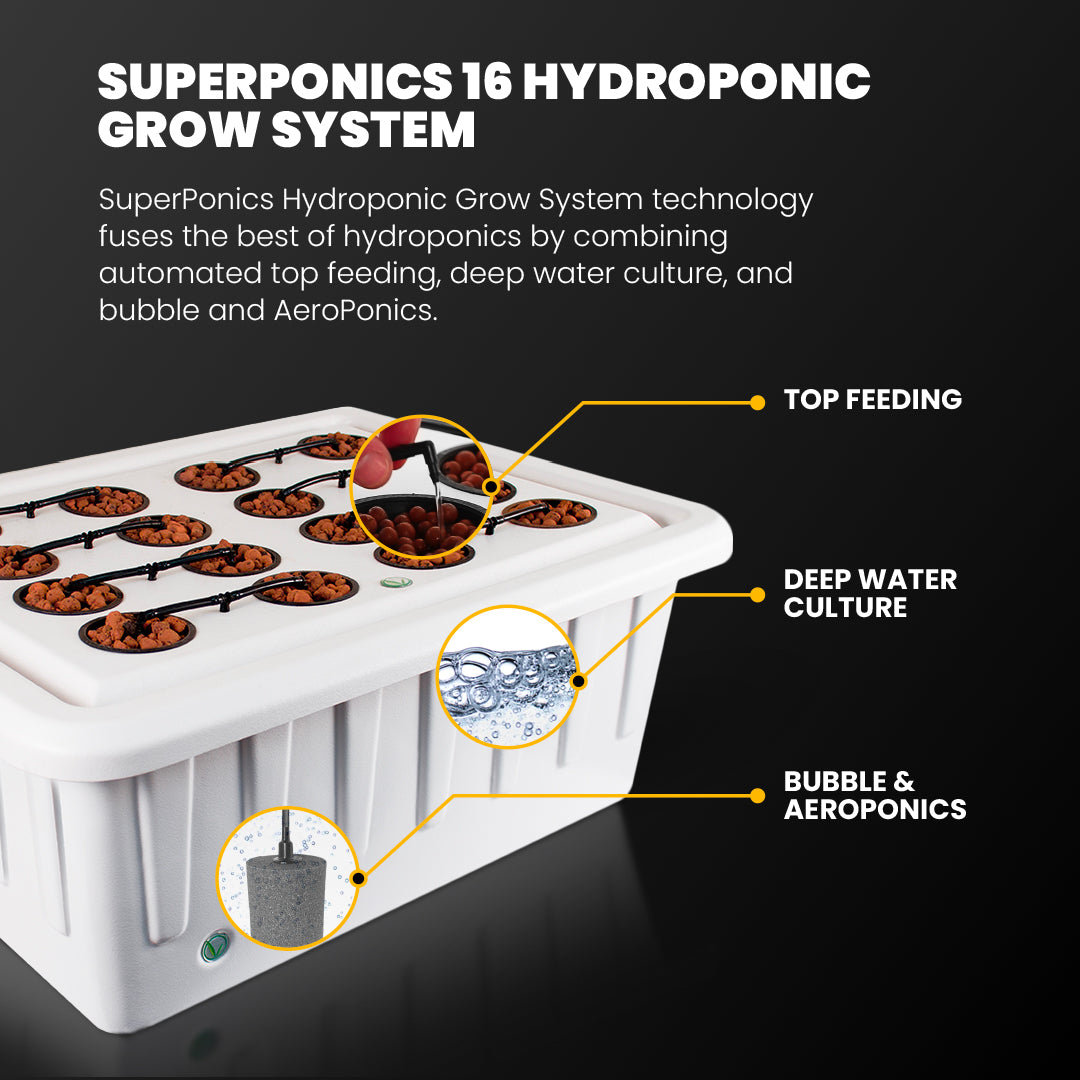

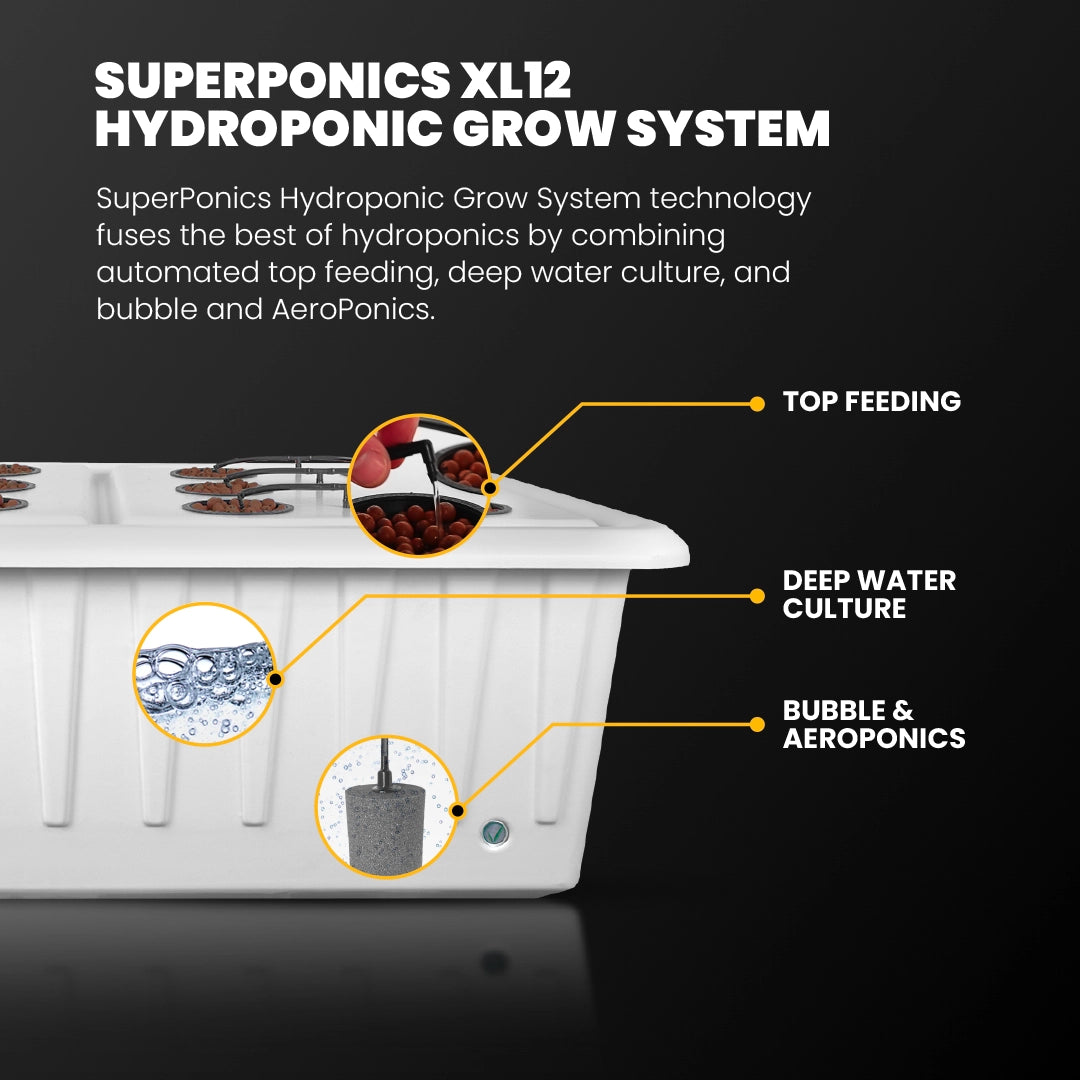

A hydroponic grow system is a collection of components and equipment that work together to create an environment in which plants can grow without soil. These systems typically include a grow tray or container, a water pump, a nutrient solution, a growing medium (such as coconut coir or rock wool), and a grow light. Depending on the type of hydroponic system you choose, you may also need a timer, a pH and nutrient meter, air stones, and an air pump. The main idea behind hydroponic systems is to provide plants with all the nutrients they need to grow and thrive in a controlled and optimized environment. By carefully regulating the amount of water, light, and nutrients that the plants receive, hydroponic growers can achieve faster growth rates and higher yields compared to traditional soil-based gardening.

There are many different types of hydroponic systems available, each with its own unique features and benefits. Some popular types include deep water culture, nutrient film technique, ebb and flow, and aeroponics. It's important to choose a hydroponic system that is well-suited to your needs and the plants you want to grow and to follow the manufacturer's instructions carefully to ensure success.

It's also a good idea to consider factors such as the size of your grow area, the amount of light available, and the type of plants you want to grow when choosing a hydroponic system. Some common types of hydroponic systems include deep water culture, nutrient film technique, ebb and flow, and aeroponics. Each type has its own unique benefits and drawbacks, so it's important to do your research and determine which system is best for your specific needs. When shopping for a hydroponic system, look for one that is easy to set up and use, made from high-quality materials, and comes with comprehensive instructions and support.

At our store, we have a wide range of hydroponic systems to choose from, each carefully selected for quality and performance. Whether you're a seasoned grower or a beginner, you're sure to find the perfect system for your needs.

Experience the Benefits of Hydroponic Gardening with Our Innovative Systems

Our hydroponic grow systems are the result of years of research and development and are made from the highest-quality materials to ensure long-lasting performance. Whether you're a seasoned grower or a beginner, our systems are easy to set up and use and come with comprehensive instructions and support. Our hydroponic systems are designed for both seasoned growers and beginners and are made from the highest-quality materials to ensure long-lasting performance. The systems are easy to set up and use and come with comprehensive instructions and support. We believe that everyone should have access to the benefits of hydroponic gardening, we're making our systems available at an affordable price. Whether you're looking to grow herbs, vegetables, or flowers, you'll find the perfect system to meet your needs.

Transform Your Gardening with Our Advanced Hydroponic Grow Systems

We can't wait to help you get started on your hydroponic gardening journey! We're here to help, and we're committed to providing the best possible customer service. Don't forget to take advantage of our expert advice and support. Our knowledgeable staff is always available to answer your questions and help you choose the best system for your needs. Whether you're looking to grow herbs, vegetables, or flowers, we have the expertise to help you get started. So, why wait? Start discovering the many benefits of hydroponic gardening for yourself.

Take the first step towards better, faster, and more efficient plant growth with a hydroponic system from our store. We look forward to helping you achieve your gardening goals!